Deflationary Spiral¶

A deflationary spiral is simply deflation (lowering of prices) due to prior deflationary pressure. Many would-be critics will claim that Bitcoin cannot succeed because it is deflationary by nature and would create a deflationary death spiral.

These kind of criticisms tend to be poorly thought out (and unfounded by empirical evidence), mostly naive rationalizations to justify the continued non-sustainable debt cycle of fiat-funded economics. However, in a debt-backed economy, like our current USD petrodollar, any kind of deflation is in-fact deadly due to the cost of the debt increasing.

Debt-backed Money¶

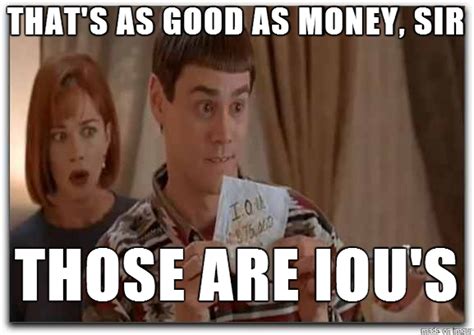

Debt-backed money like the USD petrodollar is essentially an IOU

The modern USD is an "IOU" from the Federal Reserve, a promise that they'll provide value in the future -- yet that future never comes. They just print more money (expand their balance sheet) to manage the ever-increasing debt.

Debt management becomes difficult if not impossible in a deflationary environment, which is why inflation is the necessary tool of central banks managing debt-backed money via fiat. If your money is based on debt, and you can increase the supply at will (lowering the value of your debt) then all that is needed is to maintain inflation (literally by fiat) without destroying confidence in the currency.

Strong money, like Bitcoin, is effectively the antithesis to debt-backed money -- punishing debt and rewarding saving. And yes, deflationary spirals are indeed a threat to debt-backed money -- but not to Bitcoin. Bitcoin is effectively non-compatible with debt-backed money.

Great Depression¶

The most common example of a deflationary spiral is the Great Depression, somehow confusing deflation based on economic contraction with deflation based on economic growth. But even so, was deflation the cause of the Great Depression?

The displaced farmers were not sitting on stockpiles of gold, refusing to spend because the value of their savings was increasing. The displaced farmers had no savings, they were starving as their livelihoods were replaced by tractors and industrialization. Any gold they had would have been spent on food (leading to price inflation as their savings became liquid).

Blaming the Great Depression on deflation should be considered too stupid and detached from reality to take seriously. However, we can still attempt to steel-man this issue and discuss the potential disadvantages of a strong money (specifically, a deflationary currency).

Price Deflation¶

Deflation from economic depression is not the same as deflation from economic growth. This should be obvious, but our current economic models somehow -- conveniently for those benefiting from inflation -- miss this point entirely.

Obviously, deflation due to economic contraction is bad. Prices shrinking because no one has money to spend -- this is bad.

However, prices dropping because of economic growth -- such as the price of consumer electronics over the last few decades -- this is good, very good. This is the good kind of deflation that never gets mentioned by fiat-funded academics (this is what fueled our economy over the last few decades).

Price deflation very clearly increases economic activity, and during times of economic growth this should be encouraged. This is, in fact, exactly what a strong money like Bitcoin encourages. Bitcoin is deflationary only due to economic growth.

When there is an economic contraction, Bitcoin behaves the opposite -- prices will inflate as there is simply less goods being produced (constraining supply). Yet what happens when there is a surplus of goods during an economic downturn?

This is unfortunately what happened during the Great Depression. The farmers didn't return to their small family farms after the recovery. Their jobs and homesteads were replaced by tractors. Industrialization is what displaced those farmers, leading to a surplus of workers and not enough jobs.

The "recovery" happened when those displaced farmers found new jobs in factories. Pretending that money printing would have solved this phenomenon is foolish. Printing money during an economic depression does not solve the cause of the depression, it merely enriches the recipients of the printed money and leads to the problems of fiat money.

However, what would have happened had Bitcoin existed during the Great Depression? Let's imagine that the farmers would still have been displaced. Unemployment would have still been high. A surplus of goods would still have occured, leading to reduced prices, the bad kind of deflation.

Overall, Bitcoin does not seem to help in these situations, and it does not pretend to. What Bitcoin does is provide protection to your savings should overzealous central planners try to "fix" an economic contraction through debasement of your savings. Central planners believe they can help (by spending money that's not theirs), and yet all they can do is make things worse and rationalize their failings into absurd narratives -- such as pretending world wars and depopulation are good for an economy.

The Ugly Truth¶

What Bitcoin can do during an economic contraction is send clear price signals. We may not like the signal, but printing money to obscure the truth is a far worse option. Reality is not made by fiat, which is exactly what fiat money aims to do.

Bitcoin, during the Great Depression, would have revealed that the price of manual labor on a farm was no longer sufficient to sustain a family, nor was a small family farm sufficient to sustain a family. We know this in hindsight, but how useful would this have been to those farmers? Having known earlier would have saved many families from the degradation of pretending otherwise, of pretending that reality is controlled by politicians.

Whether we like it or not, Bitcoin will reveal the true price of money itself, as well as the true price of food during a depression. Bitcoin offers truth, the rest -- as always -- is up to us.