Bitcoin as a Store of Value¶

Most people first learn about Bitcoin as a risky investment, a speculative gamble on future wealth. They buy Bitcoin hoping to get rich, thinking in terms of fiat money (such as a USD unit of account). Later they might realize that Bitcoin's fixed supply makes Bitcoin a store of value, a superior store of value. In fact, Bitcoin's early adoption is arguably due to its role as a long-term store of value.

As people increasingly look to Bitcoin as a store of value, rarely do those same people think of Bitcoin as a unit of account. Bitcoin is not necessarily any stronger as a store of value than it is as a unit of account, quite the contrary. As powerful of a store of value as Bitcoin might be, it is fundamentally a unit of account.

Digital scarcity in a trustless and completely transparent network provides a global unit of account, and the clearest signal possible for price discovery. It is a delightful (and arguably necessary) side effect that Bitcoin is also a superior store of value.

Encountering Bitcoin¶

In the future -- if Bitcoin is true -- people will first encounter it as a unit of account, that is, as prices in the market. And if they participate in the market they will experience Bitcoin as a medium of exchange. And then lastly, when they save for the future, then and only then will they experience Bitcoin as a store of value. Speculative gambles will still exist, including as priced risks known as "investments", but money itself is not a speculation, it is a unit of account, a medium of exchange, and lastly a store of value. This may all seem odd and overly simplistic, but it is the inevitable consequence of Bitcoin being true.

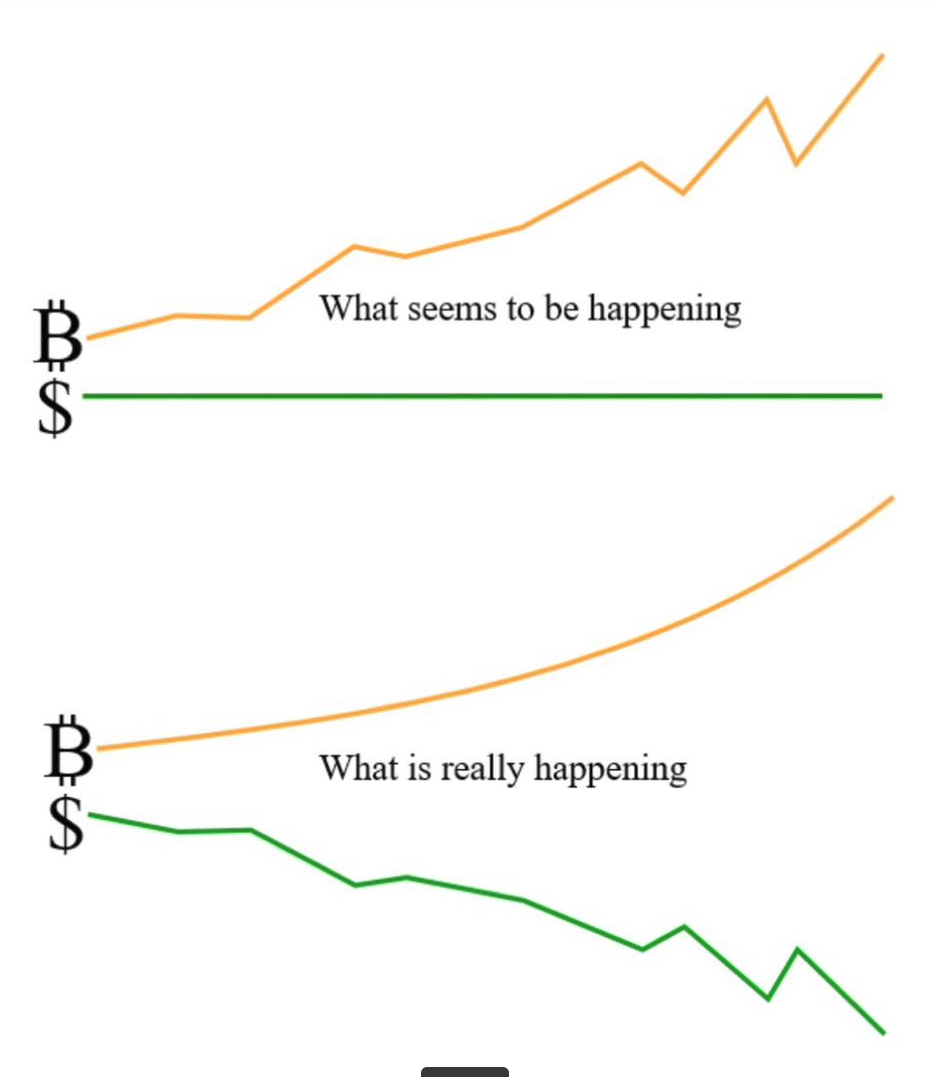

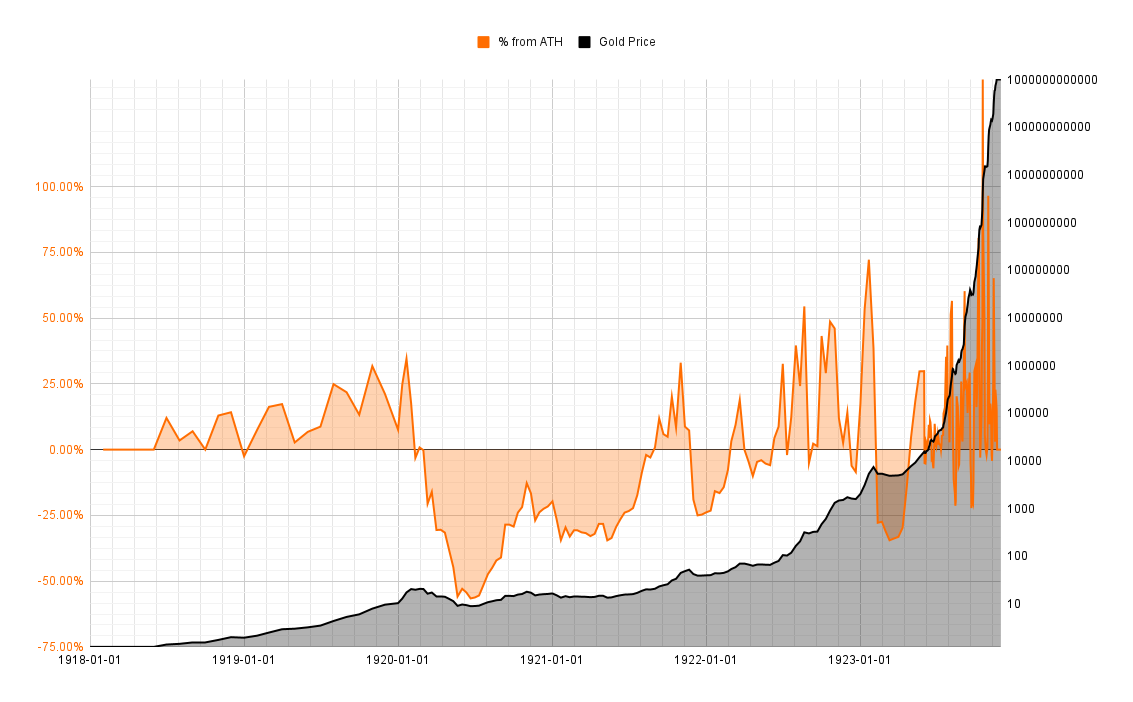

Today, we approach Bitcoin somewhat backwards, starting with a store of value. We do this because we live under fiat, and fiat is a broken store of value. The price of Bitcoin in fiat is extremely volatile, which is not a reflection of Bitcoin but rather the speculative nature of fiat-minded individuals desperate to play the fiat game. In other words, they're trying to store value in fiat by buying and selling Bitcoin, trying to time the market, which does not and can not work. Similar things happened with the gold price in the dying days of the Weimar Republic. The volatility of the gold price was not a reflection of gold, but of the hyperinflating money, the inevitable death throws of fiat money.

During the final years of the Weimar Republic the price of gold was extremely volatile. Was this a reflection of the volatility of gold? Was gold failing as a store of value? Clearly no, the currency hyperinflated until it collapsed, leaving gold as the only store of value. And only afterwards can markets emerge with proper price discovery. The effects of fiat all tend to follow this same pattern, even USD.

The only way to store value in a fiat system is by rent seeking parasitism, such as buying houses with cheap debt and renting to people who cannot afford to buy a house. A process that is as morally corrupt as it is unsustainable.

Overcoming Fiat¶

If you naively attempt to store value in fiat, it will lose its value over time. If you need to move large amounts of fiat from one country to another, it will likely be confiscated or unjustly taxed. This is because there are many competing fiat currencies and fiat voices (so-to-speak). Fiat money is inextricably bound to politics and cultural norms. It is afterall only an expression of those who speak it into power.

Simply put, fiat cannot function as a store of value. This is why fine art has become so corrupted, why real estate and equities are over inflated. People cannot store wealth using fiat money, so they seek to preserve wealth through other means, typically malinvesting (investing in index funds not as a priced risk, but as a malinvested store of value). The only successful store of value under fiat is rent-seeking with privileged access to the money printer (to cheap debt).

Equities (vs gold)

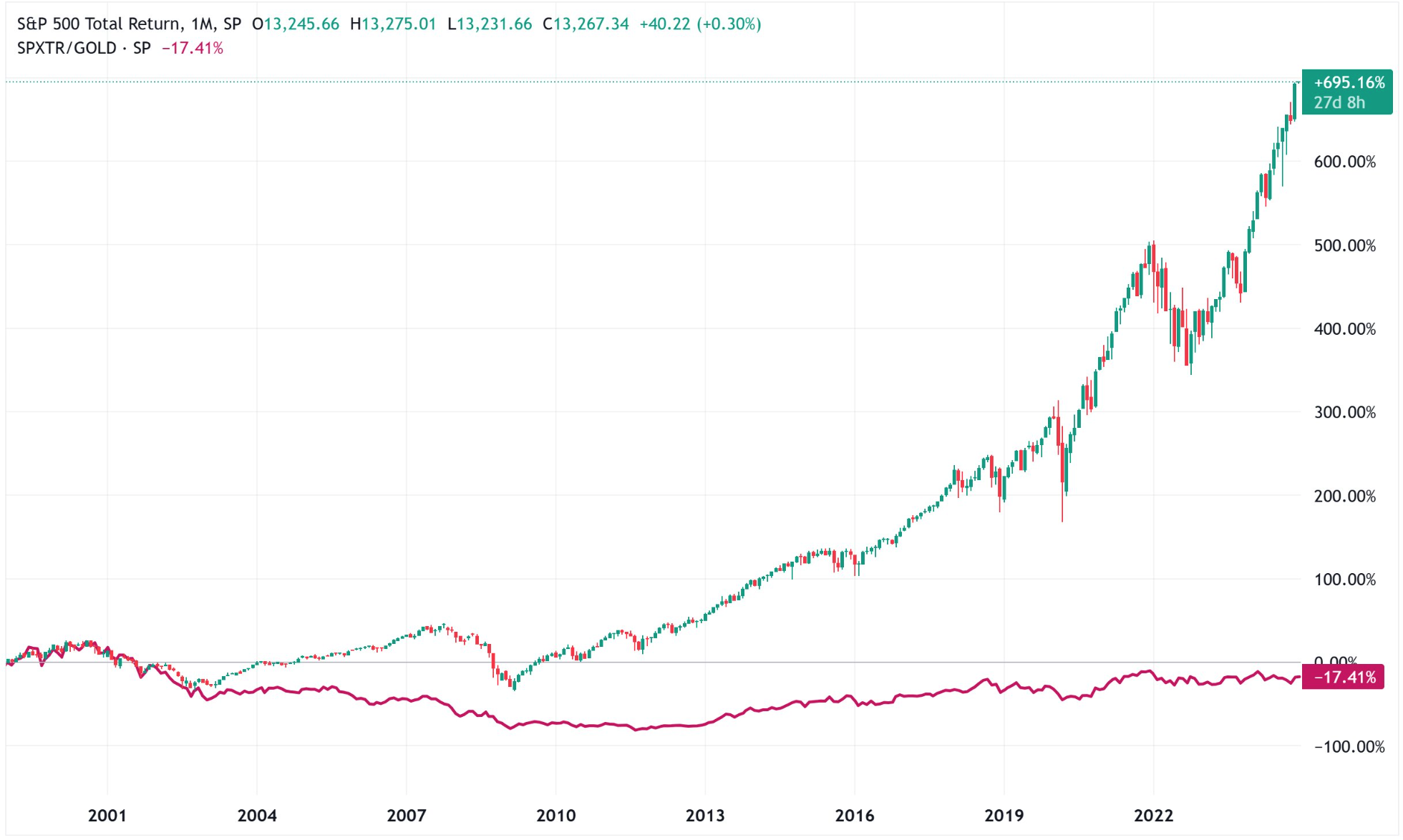

The snake-oil salesmen of "modern monetary theory" would have you believe that economic growth depends on inflationary money; after all, they claim you can store value in productive index funds such as the S&P 500.

Here is a comparison of the S&P 500 to itself (but priced in gold) since the year 2000.

Bitcoin -- if it is true -- is a superior store of value to fiat and even to gold (the most effective store of value the world has ever known). Over time Bitcoin will gain adoption and value, and it can do this while being transferable anywhere on earth, unmolested. Neither gold nor fiat nor real-estate nor even fine-art can function as a better store of value than Bitcoin.

Fiat Volatility

Bitcoin is often criticized as being "too volatile". However, even as measured in fiat, Bitcoin is by far the highest-performing asset of all time. And considering that 80% of all USD was created in the last 5 years, one may want to consider that it is fiat volatility that is confusing price signals -- after all, the Bitcoin supply has stayed fixed and predictable, with growing adoption.

For better or worse, Bitcoin price movement is a slow process of price discovery --

as those who understand the fundamentals of money would never sell Bitcoin for fiat,

and ultimately Bitcoin finds its way into stronger hands, sending its fiat price higher and higher.

The weaker money will be overproduced to satisfy the demand for the stronger money.