Bitcoin's Monetary Policy¶

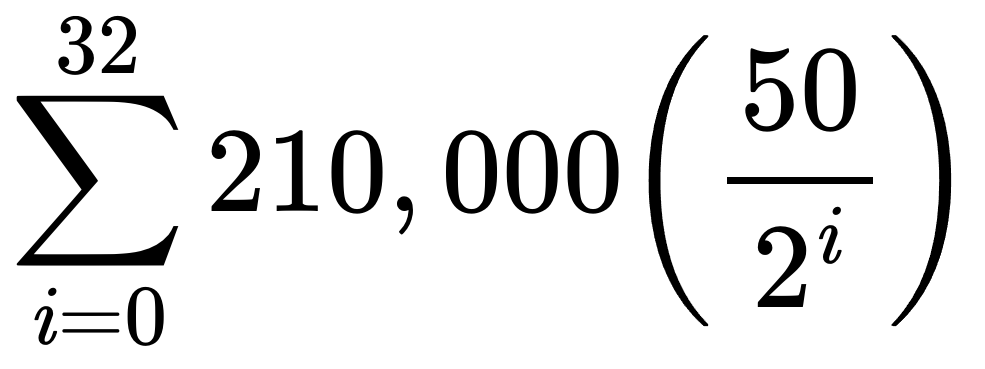

The following equation contains the entirety of Bitcoin's monetary policy:

If you calculate the above summation, it is approximately 21-million.

asymptotic limit

Technically, the total supply of Bitcoin will be capped at 20,999,999.9769. This is because there are only 32 halvings until the block subsidy will be zero.

If you were to replace the 32 with infinity, then the above equation would equal 21-million as an asymptotic limit. That is, it would take infinite time and infinite decimal places to get to 21-million.

Monetary Equation¶

The equation (Bitcoin's monetary policy) breaks down as follows:

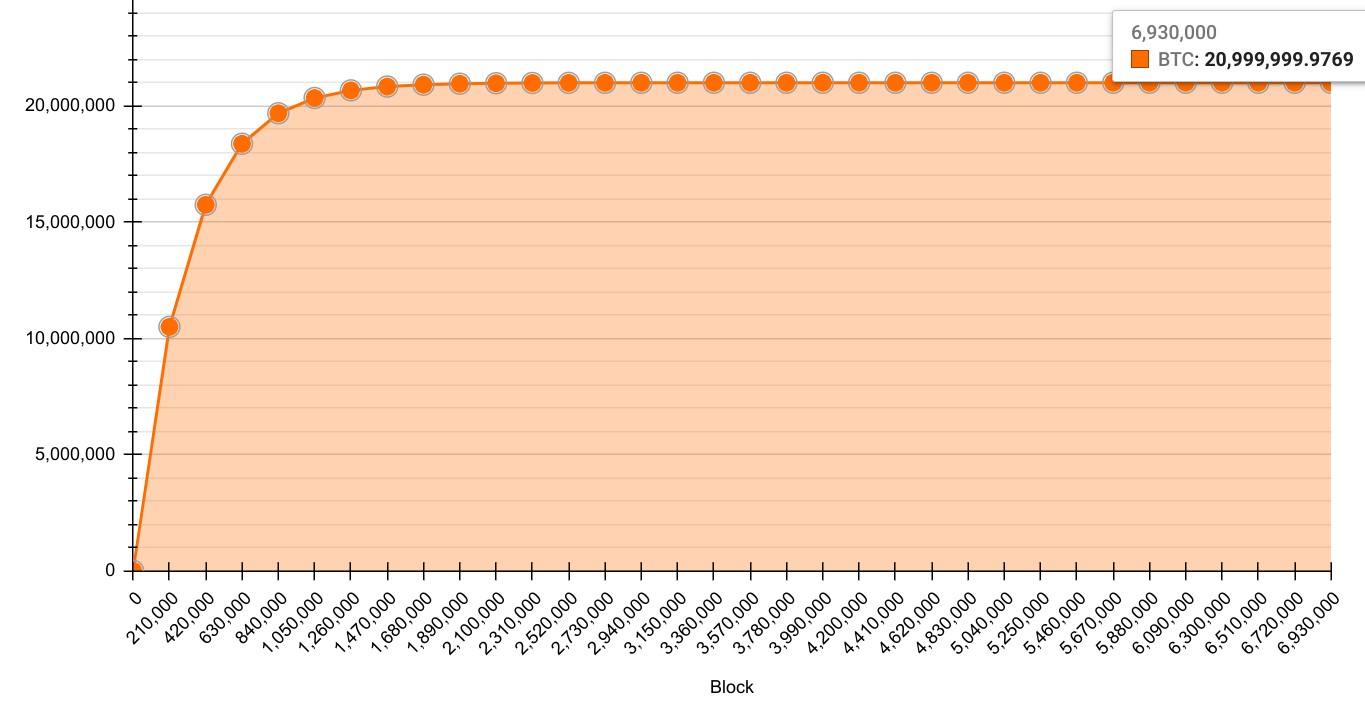

There are 33 block-subsidy eras (0 to 32), each lasting exactly 210,000 blocks. This means each era is roughly 4-years, for a total of 132 years till the final Satoshi is issued.

Each era halves the block-subsidy, and after 32 halvings the subsidy would result in a number too small to represent in Satoshis, hence the subsidy will be zero.

At that point (block 6,930,000 in the year 2140), there will have been 20,999,999.9769 Bitcoin block subsidies, and from then on Bitcoin mining will operate only on fees (which in practice will have already happened as the prior era subsidy will have already been a single Satoshi).

Supply over Time¶

One of the reasons Bitcoin's ledger can be referred to as a timechain is because we know the future supply schedule, e.g., we know the final Satoshi will be issued in the year 2140. This is an often overlooked point. The issuance of Bitcoin is not dependent on its value. Let's repeat that:

Issuance of Bitcoin is not dependent on its value.

Imagine if the spot-price of gold or silver jumped up to over $1-million. That is, an ounce of silver would fetch more than $1-million. You might go looking for old silver dollars. And how do you think this would effect silver mining?

This is so fundamental as to be a law of nature. Increased demand will result in more production. And yet if Bitcoin price goes to $1-million or more, the issuance of new Bitcoin will remain on schedule. Issuance of Bitcoin depends on time. Let's repeat that:

Issuance of Bitcoin depends on time.

What would happen if, tomorrow, the price of Bitcoin went up to $1-million? Mining would be very profitable. The hashrate would skyrocket. And yet, issuance of new Bitcoin would stay on schedule. This is due to the difficulty adjustment.

Difficulty Adjustment¶

Every 2016 blocks there is a difficulty adjustment to maintain a 10-minute average block time. That is, if the average time between each of those 2016 blocks is less than 10-minutes, the difficulty will increase. If the average is more than 10-minutes, the difficulty will decrease. For this reason, while the time between blocks can vary, the average remains 10-minutes.

Without a doubt, this is Satoshi Nakamoto's greatest innovation. Unlike all prior attempts at digital money, this is why Bitcoin worked, and continues to work. This is why Bitcoin is not and never was tulip mania. If tulip prices increase, so too will tulip farming, because tulips are not a scarce asset.

Increases in the valuation of Bitcoin will lead to more mining as it becomes more profitable, yet those increases will in turn lead to a difficulty adjustment such that the increased mining does not alter the supply schedule. The difficulty adjustment is why Bitcoin's monetary policy will always follow a rather predictable future supply schedule.

This seemingly benign difficulty adjustment is what makes Bitcoin the scarcest asset the world has ever known. Or rather, the coalescence of a decentralized ledger, proof-of-work issuance with a difficulty adjustment, and enforced through a consensus protocol -- all of this in harmony is what make Bitcoin the scarcest and most uncorruptible asset that has ever existed.