Fixed Supply¶

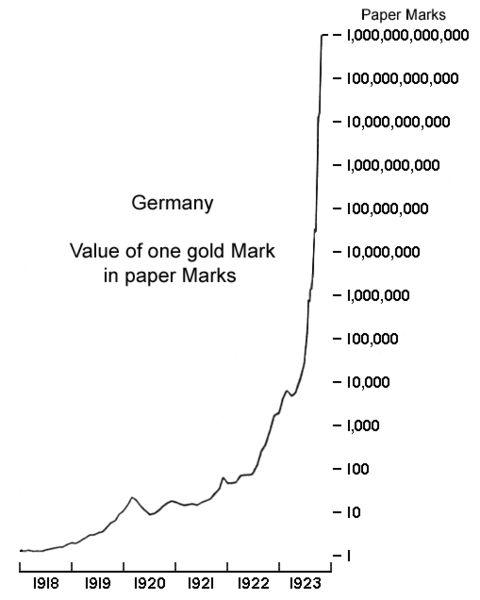

Let's consider this classic chart that you may have seen in various corners of the Internet.

Weimar Gold Price from 1918 to 1923

I've seen many versions of this chart, and always felt there was a lot overlooked. Yes, it's a textbook example of fiat currency hyperinflation, but let's dig a little deeper.

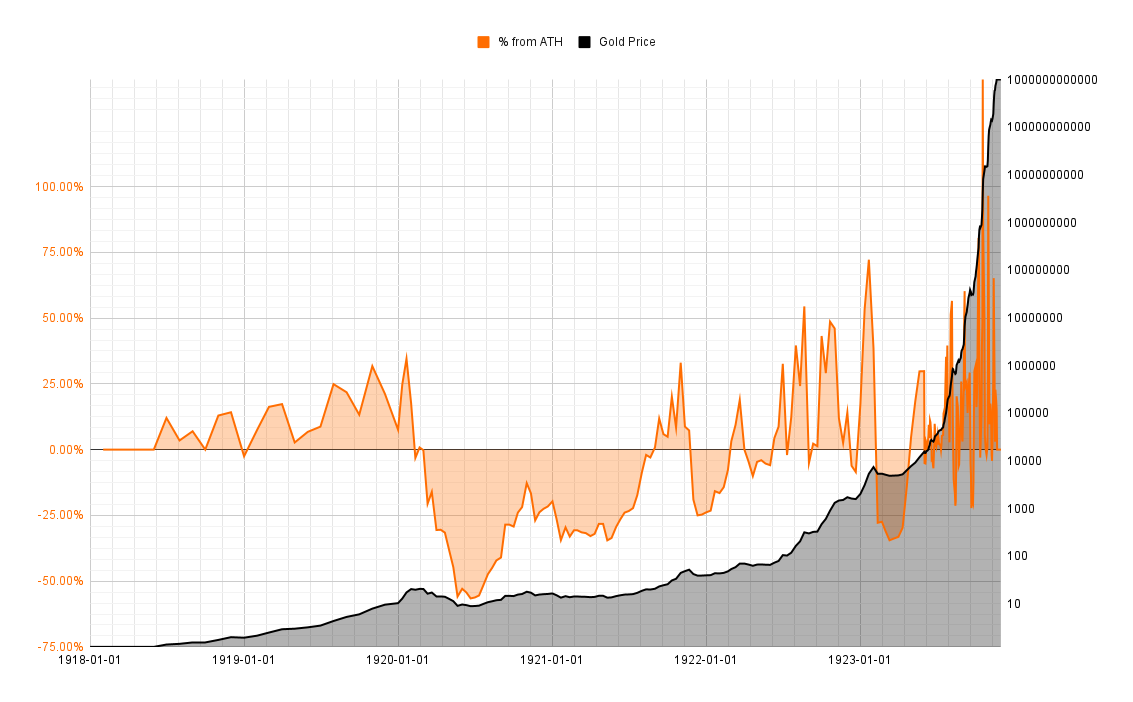

We can find the raw Weimar Inflation Data online, and using this we can plot the classic hyperbolic price of gold shown above. Additionally, we can track things like the all time high (ATH) and changes to that ATH. We can scale this out to get a better look at the volatility in the gold price over time. For example,

This gives us two distinct stories. We know the story of the gold price. Inflationary paper money will inevitably end this way. However, the volatility is an often overlooked story -- as something as stable as gold became volatile.

There was extreme volatility in the price of gold, as well as in real estate and other hard assets. For well over a year the price was dropping, crashing to less than 50% of its all-time-high (ATH). And then every time there was a new ATH, it was followed for months on end of a painful bear market. And then the process would repeat. The frequency of these painful cycles increased, as did the volatility.

The people of Germany in 1921 lacked the benefit of hindsight that we have looking at this classic story of a currency collapse. Instead, they lived through massive uncertainty, holding gold through periods where it seemed to be losing value. And then other periods where the number would go up-and-up, only to crash once again -- until finally, the German Papiermark itself crashed, hyperinflated into oblivion.

A fixed supply is not only important, but critical. And as all fiat currencies have demonstrated, inflation is impossible to avoid. In the early days it can be tamed and even reduced, but eventually it grows along with all the consequent problems of fiat money.

Is a Fixed Supply Feasible?¶

A fixed supply is not possible through wishful thinking nor central planning. These attempts have all failed, and continue to fail.

Gold and silver were more successful as money than other metals simply because their supply was more limited. And yet, the inflation rate of gold (the increase in supply) has historically hovered around 2%. That means every year there is 2% more gold than the previous year. A gold standard means 2% annual inflation.

At present, Bitcoin's inflation rate is already less than gold, and as such, Bitcoin is the least inflationary monetary asset the world has ever known.

How is it Possible?¶

Many Bitcoiners will tell you to read the code.

And yes, the code at the moment will fix the supply to just under 21 million.

GetBlockSubsidy

Every 210,000 blocks (roughly every 4 years) the block subsidy (new Bitcoin mined) is reduced in half, and it started at 50. You can calculate 50 times 210,000 to arrive at 10.5 million, exactly half of 21 million. Afterwards, the block subsidy was "halved" to 25, then to 12.5, then 6.25, then 3.125, and so on.

This "halving" process will contiue until the year 2140 when the final fraction of a Bitcoin is mined, at which point mining will operate only on transaction fees.

CAmount GetBlockSubsidy(int nHeight, const Consensus::Params& consensusParams)

{

int halvings = nHeight / consensusParams.nSubsidyHalvingInterval;

// Force block reward to zero when right shift is undefined.

if (halvings >= 64)

return 0;

CAmount nSubsidy = 50 * COIN;

// Subsidy is cut in half every 210,000 blocks which will occur approximately every 4 years.

nSubsidy >>= halvings;

return nSubsidy;

}

>>= operator in the code is a bit shift right,

which has the effect of halving a number, e.g.,

50, 25, 12.5, 6.25, 3.125, 1.5625, ...

But this doesn't answer the question.

How can I know that this fixed supply won't change in the future? How do I know we're not one pull-request away from inflationary money? How do I know that the future supply of Bitcoin won't be controlled by incompetent bureaucrats?

Well, it's open-source code.

Try modifying it and see what happens. Create your own pull-request to change this function. Now, obviously such a change won't be approved, but what if it was? Let's say the supply cap was changed -- would that be the end of Bitcoin?

Such a change would break consensus rules, and would be considered a hard fork, that is, the original software would reject all new blocks on this new version, and it would require all the miners and nodes to upgrade. A conscious choice amongst every participant in the Bitcoin network.

Those that refused would just continue as they were, running nodes, mining blocks, and transacting Bitcoin based on the 21 million fixed supply. The developers that refused would continue developing the original version and would enjoy the support of everyone who wished to stay on the original fixed supply version.

This is, it turns out, exactly what has happened many many times before. The so called altcoins (or shitcoins) are the result of exactly these kind of hard forks. Their adherents chose the hard fork, and the market reacted accordingly.

So far, against many challenges, Bitcoin's fixed supply has proven true.