Bitcoin as Money¶

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take them violently out of the hands of government, all we can do is by some sly roundabout way introduce something they can’t stop.”

~ Friedrich Hayek

If Bitcoin is true, it must be Hayek's "something" that government can't stop. It must be a de-facto superior money to USD, as well as to all fiat money. It must be so superior that it's ascent is only a matter of when and not if -- this is the only way Bitcoin could be considered true.

Global Money¶

Money is the technology that makes known the ever-changing perspectives of value of every human being on earth. Additionally, money must store value over time, and it must be transmittable over large distances, anywhere that humans wish to transact.

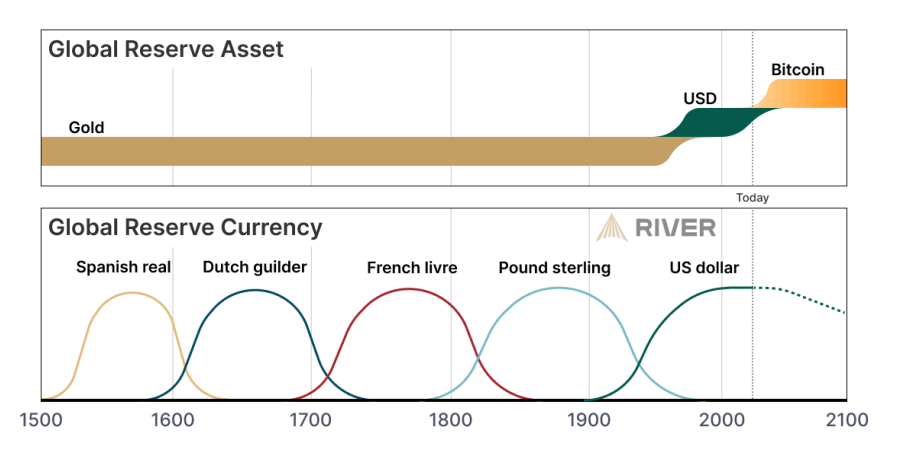

There has never been a true global money, that is, a money that everyone on earth agrees on as their unit of account, their medium of exchange, and as their store of value.

Such a technology has never existed, least of all because such a global money must be properly decentralized and uncensorable. Importantly, anyone who controls monetary technology would have power over everyone else wishing to transact with that money. A global money could only be possible if no one controlled it.

As such, Bitcoin can only be true if no one can control or limit who can use it. This means attempts to ban it must fail, as well as attempts to subvert or control its monetary policy.

Gold and Silver¶

The closest to a global money was gold and silver. One could travel with gold, and use it in most places, provided it was not seized or stolen.

Kingdoms and empires fell, but if their coins were in gold, the monetary value of that gold was preserved and spendable elsewhere. Wars were fought over gold, and if you managed to hold onto your gold, not a paper note but the gold itself, that gold would hold its value over time.

For example, under the gold standard $20-USD was roughly an ounce of gold. An unskilled worker might earn only 25-cents per hour -- a mere $40 per month -- 2-ounces of gold per month. At today's gold price this is well over $30/hour.

Gold-backed money provided a living wage to even the lowest paid workers.

Unfortunately, gold cannot be transmitted quickly nor cheaply over large distances. This limitation gives rise to an inevitable system of credit, and then to promisory notes which then lead to fractional reserve, and stey-by-step to pure fiat; money that is backed by-- what exactly?

Petrodollar¶

Today, the world operates on a quasi-global currency known as the USD, or more aptly, the petrodollar. It began after 1971, after a sovereign debt default which ended what was left of the gold standard.

For all its faults, the petrodollar system makes the USD a stable global reserve currency which is why you can freely exchange your USD to Canadian dollars or Euros or Yen or Yuan. Almost anywhere on earth you go, you can probably find an ATM that will allow you to withdraw the local currency (at a relatively stable exchange rate). Despite the many problems of fiat money, this innovation was itself revolutionary, allowing decades of economic growth on a global scale.

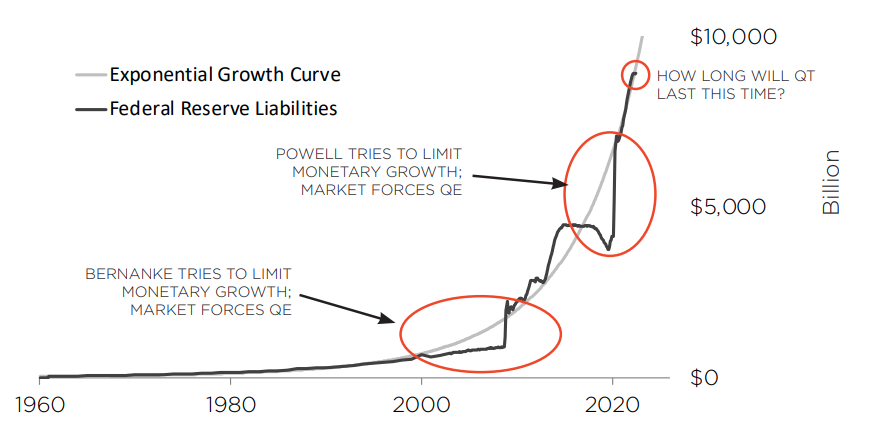

The dirty secret was that this economic growth hid the seigniorage of central bankers that has inadvertantly bankrupted every country on earth, strip mined capital, transformed stockpiles of wealth into an unsustainable mountain of debt that can never be paid back (it is money backed by debt afterall).

And of course, the not-so-secret secret, this system requires continuous war over oil.

The petrodollar system depends on two critical elements,

- US military dominance

- US relations with oil-rich nations (like Saudi Arabia)

In other words, if Saudi Arabia and other oil-rich nations should fall, the USD petrodollar would collapse overnight. Similarly, if the US military was not the de-facto dominant power on earth, then the USD would collapse (hyperinflating against stronger money). Likewise, if the US government was to collapse, so too would the USD petrodollar system. This bizarre web of dependencies is what it means today to be the global reserve currency.

Unlike gold and silver, the petrodollar depends entirely on the US government, the US Treasury, the Federal Reserve, the US military, the Saudi government, and a stable relationship between the US and the Saudis.

Fiat Interregnum¶

While fiat is (by definition) legally enforced as a medium of exchange, it fails as a store of value, distorting price signals, and ultimately failing as a reliable unit of account. Fiat money inevitably creates a dual money system, where weak "currency" is separated from monetary "assets"; in other words, the masses earn fiat while the wealthy store value in hard assets (gold, real-estate, equities, or even fine-art).

Bitcoin need not be adopted nor even accepted by the fiat bureaucrats; the truth of Bitcoin is not determined by fiat. For Bitcoin to be true, it need only to work. International settlements must work using Bitcoin. And doing so will reveal the impotence of the parasitic bureaucrats that imagine themselves as in control. Bitcoin is true because it works, and the consequences of that may not be agreeable to most (least of all to the beneficiaries of the fiat system itself).

The fiat system produces bureaucratic cruft, delusions of power that arise from the noise of the system, obscuring price signals and creating a class of professional bureaucrats whose job it is to pretend to control money. Bitcoin doesn't make them obsolete, it proves they have been impotent all along, like court astrologers.

Under the gold standard, it wasn't the king that gave value to money, it was the gold. The monetary value of gold was all that mattered. Similarly, under a Bitcoin standard, Bitcoin is all that will matter, not its adoption by bureaucrats.

In the long arch of history, the modern fiat system is a mere blip as we transition from gold to true global money. This blip of modern fiat was birthed in 1971 although didn't really prove itself till a few years later. By the 1980s it was ostensibly working, and it was uncontested until 2009, until Bitcoin. And in a sly roundabout way, Bitcoin has risen into prominence as an open source global money, poised to supplant the USD petrodollar. And with every decade of it working, it inches closer to becoming the money of international settlements, the base layer behind all money.