Understand the Terms¶

Bitcoin is unlike anything that has ever existed.

Bitcoin is unlike any money the world has seen. It is unlike any technology or network -- there's really nothing like it in history. As a result, any attempt at explaining Bitcoin will rely either on imperfect metaphors, or novel technical terms. For example, the word custody is a misnomer, an anachronism from a simpler time when banks would custody your gold.

In reality, there are no actual coins to custody. Bitcoin is pure information; information copied publicly in a cryptographic ledger. Everyone can have a copy of the ledger, and everyone can validate that the ledger is correct. And similar to how the Internet empowered individuals to share ideas with the world, Bitcoin empowers individuals to custody their wealth, and to do so in ways far more secure than any bank ever could.

And because Bitcoin is money, there are many traditional metaphors (such as wallets, coins, and addresses) that can be useful, but at the same time may lead to a great deal of confusion. Bitcoin is in a category all to itself -- the physical limitations of custody, wallets, coins, and addresses simply don't apply to Bitcoin. And thus to custody your Bitcoin, means something very different than anything you've thought about before Bitcoin.

We will describe these imperfect metaphors and attempt to demystify them, and then discuss the more accurate technical concepts necessary for understanding the truth of Bitcoin and what it really means to custody your Bitcoin.

Wallets¶

In Bitcoin, the word wallet is a misnomer, possibly the most confusing metaphor in Bitcoin. The term wallet in Bitcoin can mean different things. It can refer to a collection of private keys, or invoice addresses, or UTXO sets, or as the hardware or software to manage any of the above. But a Bitcoin wallet is most certainly NOT a collection of your Bitcoin.

There is no Bitcoin stored in a Bitcoin wallet.

The traditional meaning of the word wallet simply doesn't apply to Bitcoin.

The word wallet was used in Bitcoin because the original Bitcoin core client app would store private keys in a file named wallet.dat.

Hot Wallet¶

A hot wallet refers to any software or hardware that stores your private keys in a device connected to the Internet, allowing you to send and receive Bitcoin. If a private key is directly accessible to an online device, this makes it hot.

E.g., if you have a Bitcoin wallet app on your phone that can send and receive Bitcoin, this is referred to as a hot wallet.

Cold Storage Wallet¶

If you store private keys offline, in a device never connected to the Internet, this is referred to as cold storage. There are obvious security benefits, and cold storage is the recommended approach for safe custody of your Bitcoin.

There are many cold storage practices, and they follow a standard pattern,

- private keys are stored offline (e.g., in an air-gapped device).

- public keys can be stored in an Internet-connected device.

- for receiving Bitcoin,

- the public key can generate receive addresses, and

- verify transactions.

- for sending Bitcoin,

- the public key can generate an unsigned transaction, then

- the unsigned transaction is transfered to the air-gapped device, then

- the transaction is signed on the air-gapped device, then

- the signed transaction is transfered to an Internet-connected device, and then broadcast to the network.

There are many variations of cold storage but they all adhere to the above pattern; sometimes with additional steps meant to increase security.

E.g., using a seed signer, a private key is never stored in any electronic device, air-gapped or otherwise. Instead the key is generated from the seed phrase and used on a signing device only when needed (and discarded immediately afterwards).

Wallets Demystified¶

A Bitcion wallet is not a collection of your Bitcoin. Rather, a Bitcoin wallet is any device or procedure used to manage your private keys (necessary to send and receive Bitcoin).

Keys¶

Not your keys, not your Bitcoin.

It is your Bitcoin keys that you custody. Specifically, you custody your private keys, usually by storing the seed phrase that can generate your private keys and their corresponding public keys.

If you're unfamiliar with these concepts (public key cryptography and elliptic-curve cryptography), the purpose is that public keys can create encrypted information that can only be decrypted by the corresponding private keys. Or in the case of Bitcoin, public keys can create transaction outputs that can only be spent by the corresponding private keys. In other words, you can receive Bitcoin through your public keys (or rather, addresses generated by your public keys), and you can spend Bitcoin by using your private keys.

A seed phrase is a list of words that encode a 256-bit number that can derive private keys and their corresponding public keys, as well as the addresses that can be used in transactions. In other words, it is a phrase (typically 24 words) that can be used to recover your Bitcoin. This process of deriving keys and addresses from a seed phrase is knows as Hierarchical Deterministic (HD) Wallets.

Hierarchical Determinism¶

In practice, Hierarchical Deterministic (HD) Wallets allow you to save a single seed phrase and use that seed to derive as many keys and addresses as you need. This could be as simple as a single account with a single key that you use only once, or this could be millions of accounts used by an institution, such that each account can generate its own keys and addresses.

Brief History

Early version of Bitcoin generated private keys and addresses randomly, requiring users to backup all of the private keys associated with any of the addresses they had used.

HD wallets on the other hand can generate an unlimited number of private keys and addresses, or rather, an unlimited number of accounts, each with their own keys and address space. And all of those accounts, keys, and addresses can be derived from a single seed phrase.

Keys Demystified¶

Public keys are used to receive Bitcoin, and private keys are used to spend Bitcoin (by signing a transaction). A seed phrase can be backed up and is used to generate public and private keys in a predictable (deterministic) way, such that your seed phrase is the most critical piece of information to secure.

Addresses¶

A Bitcoin address is a misnomer, and when not understood properly can lead to a great deal of confusion. The word address implies your Bitcoin is located at this address. In reality, there is no address where your Bitcoin is located. There are only transactions, which have inputs and outputs, and the outputs are either spent or unspent.

Transaction inputs are created from the unspent outputs of a previous transaction. And these ouputs are created using an address. This makes the unspent transaction outputs spendable only by the corresponding private key associated with the address.

There are two types of addresses, receive addresses (also known as invoice addresses) and change addresses.

Invoice Addresses¶

Imagine you receive 0.006 Bitcoin to an address in your wallet.

This will create a transaction with an output using your address.

flowchart LR

subgraph TX-1

direction LR

subgraph in-1[in]

direction LR

a[0.006 BTC]

end

subgraph out-1[out]

direction LR

b[0.006 BTC]

end

end

a --> bNow imagine that you send 0.001 Bitcoin to someone else (to an invoice address they sent you).

It is tempting to think your original address now has 0.005 Bitcoin, but in reality your original address has nothing. The original transaction output is spent.

When you send the 0.001 Bitcoin, this will create a new transaction with two outputs:

flowchart LR

subgraph TX-1

direction RL

subgraph in-1[in]

direction RL

a[0.006 BTC]

end

subgraph out-1[out]

direction RL

b[0.006 BTC]

end

end

subgraph TX-2

direction TB

subgraph in-2[in]

direction RL

c[0.006 BTC]

end

subgraph out-2[out]

direction BT

d[0.001 BTC]

end

subgraph out-2a[out]

direction BT

e[0.005 BTC]

end

end

a --> b

in-2 --> out-2

in-2 --> out-2a

b --> in-2One output has 0.001 Bitcoin, and another with 0.005 Bitcoin

(for simplicity, this is ignoring transaction fees).

Your private key can access the output with 0.005 Bitcoin,

and someone else has the private key to access the output with 0.001 Bitcoin.

The output at 0.005 Bitcoin uses a change address.

The original transaction output of 0.006 Bitcoin is already spent,

and your Bitcoin is only available in the new unspent transaction outputs.

These unspent transaction ouputs are known as UTXOs (see below).

Change Addresses¶

Here is a

real transaction

where someone spent 0.001 Bitcoin from a previous

UTXO address that contained 0.006 Bitcoin.

In addition to a transaction fee of 0.00007718 Bitcoin,

there was 0.00492282 Bitcoin sent to a change address.

Every invoice address has a corresponding change address, which as the name implies, is the change of the spent transaction output.

Addresses Demystified¶

An address is not a location where Bitcoin is stored, but is a number used to generate a transaction output (see UTXOs below). An invoice address (aka receive address), is what you would use to receive Bitcoin. And when you spend Bitcoin (from an unspent transaction), any remainder will use a change address.

Transactions¶

Bitcoin is a protocol managing a cryptographic ledger, and this ledger is made up of ordered transactions. Transactions are ordered through blocks, such that a block is merely a collection of transactions.

A transaction has inputs and an outputs. The inputs must come from one or more unspent outputs of prior transactions. The only exception is the special coinbase transaction, which is the reward given to whoever successfully mined a new block (thus it has no input from a prior transaction). Otherwise, all transactions are composed of inputs from previously unspent transaction outputs (UTXOs).

flowchart LR

subgraph TX-1

direction TB

subgraph in-1[in]

direction TB

a[0.25 BTC]

end

subgraph in-1a[in]

direction TB

a1[0.25 BTC]

end

subgraph out-1[out]

direction BT

b[0.5 BTC]

end

end

subgraph TX-2

direction TB

subgraph in-2[in]

direction RL

c[0.5 BTC]

end

subgraph out-2[out]

direction BT

d[0.1 BTC]

end

subgraph out-2a[out]

direction BT

e[0.4 BTC]

end

end

in-1 --> out-1

in-1a --> out-1

in-2 --> out-2

in-2 --> out-2a

out-1 --> in-2UTXOs¶

As the name implies, an Unspent Transaction Output (UTXO) is Bitcoin that has not been spent. The Bitcoin you custody will be in UTXOs. UTXOs represent the total amount of addressable Bitcoin at any given time. Every UTXO contains an address such that the UTXO can only be spent by the private key (or keys) associated with that address.

Transactions Demystified¶

Transactions are simply the movement of Bitcoin on the ledger, such that the entire supply of all Bitcoin can be accounted for. A transaction is simply inputs and outputs which move the balance of Bitcoin to different cryptographic addresses (accessible only by private keys).

Blockchain¶

The word "blockchain" is perhaps the most misunderstood and overhyped word related to Bitcoin. Next time you read an article on "blockchain technology" replace the word "blockchain" with "magic" and you won't have changed the article's meaning.

blockchain or magic?

All the data in blockchain technologymagic is immutable

and can be adapted for use in a variety of industries,

including healthcare, supply chain management, and voting.

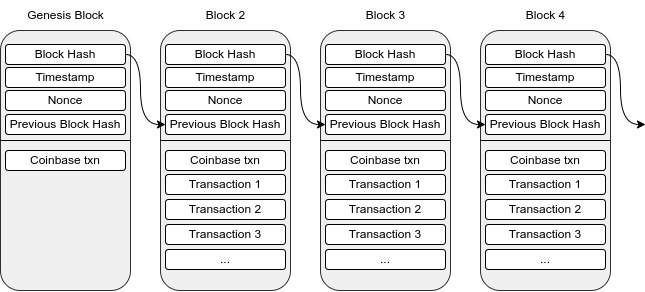

A blockchain, like the name implies, is simply a chain of blocks. And a block is a collection of transactions. That's it. It's an implementation detail as interesting as a linked list. And if you consider it a distributed database, it is a slow and inefficient database.

By itself a blockchain is not secure; it is as mutable as any other data; and it has none of the magic often associated with it (by those easily confused by the subtle differences between technology and magic). A blockchain offers absolutely no value to healthcare, supply chain management, or voting.

Ultimately, a blockchain only makes sense in the context of a proof of work (PoW) consenus mechanism whose security comes from the considerable cost of work in the PoW.

Proof of Work¶

A typical blockchain diagram will look something like this,

Each block has a hash. A block hash is a sha256 of the entire block itself (which includes the previous block hash). This is a cryptographic function that takes any input (in this case a block) and generates a 256-bit number as output. A block can be referenced by its hash as well as by block height (starting at 1). Here are some examples of actual block hashes:

- Genesis ->

00000000839a8e6886ab5951d76f411475428afc90947ee320161bbf18eb6048 - 100100 ->

0000000000020ee4806021c0b6e7b97d31df0c2fdbd0f6c3a7cb5883c7bc151f - 200201 ->

00000000000000e510b96fcf03e27ad30f8d50e4cd4cb7cf4c06cf7ffb9add3e - 300301 ->

00000000000000002887537d323675f79cc5eddce91b3c0dd433739cbfe9c823 - 700700 ->

00000000000000000000e55da58b378880e797f9f3e96811d3e64a2f801eed9a

These hashes have a lot of leading zeroes, and as time goes on, the number of leading zeroes seems to increase. This is due to proof of work (and network difficulty increasing over time).

There is a common misnomer that PoW involves solving a difficult mathematical problem. In fact, all PoW does is provide a verifiable block hash that is smaller than the current network difficulty. In other words, the hash is simply a number (a 256-bit number) that is smaller than the network difficulty number. This is why you see leading zeroes.

The reason this is a proof of work

is because generating a valid block

requires massive amounts of work.

A Bitcoin miner constantly

adjusts a proposed block

(see the nonce in the header)

and generates a sha256 hash,

essentially a guess.

Every miner repeats this, over and over,

until finally -- and by dumb luck --

the hash is smaller than the network difficulty.

If the hash is valid (adhering to consensus rules)

then the rest of the network will accept the

proposed block.

There is also a timestamp field in each block,

meaning the Bitcoin network is also a distributed

timestamp server.

This allows the PoW blockchain to keep track of time.

And due to what is known as the

difficulty adjustment,

the network will adjust the

difficulty number in order to maintain a 10-minute average block time.

The difficulty will adjust

every 2016 blocks (roughly every 2-weeks; and 2016 reversed is 6102,

a subtle reference to

executive order 6102).

This is why the PoW blockchain

is more aptly known as the

Bitcoin timechain.

Timechain¶

The PoW blockchain is better known as a timechain because it provides a chronological order to all transactions, creating its own time in the process. From the whitepaper, Bitcoin provides "a solution to the double-spending problem using a peer-to-peer distributed timestamp server to generate computational proof of the chronological order of transactions".

In other words, Bitcoin provides order that lays itself out over time; that is, we know the precise order of transactions, as well as the future supply of Bitcoin. We can predict with high accuracy what the Bitcoin supply will be at any point in the future (something you cannot do with gold or fiat).

The timechain does not repeat. There are no circular paths in Bitcoin time. It is linear, keeping a pulse, a new block, every 10-minutes on average.

Symbolically, Bitcoin is bringing order out of monetary chaos. What was once chaotic and unknowable (how much money is there and how is it distributed), is now knowable with Bitcoin in a true sense of the word order (order out of chaos).

Blockchain Demystified¶

A blockchain is a chain of blocks, nothing fancy nor magic. What changed the world was not the invention of a blockchain (something that already existed as far back as the 1990s). What changed the world was the invention of Bitcoin, a distributed timestamp server with a PoW consensus mechanism and difficulty adjustment, giving us the most sound money to ever exist.

Focusing on a blockchain as innovation is like focusing on how the Wright brothers invented a wing rather than manned flight; meanwhile Bitcoin is the invention of digital scarcity and a new form of money.